home equity loan texas rates

Home Equity Loan Rates Texas - If you are looking for a way to reduce your expenses then our trusted service is just right for you. 31 rows Texas 10-Year Home Equity Loan October 15 2022 Average Rate.

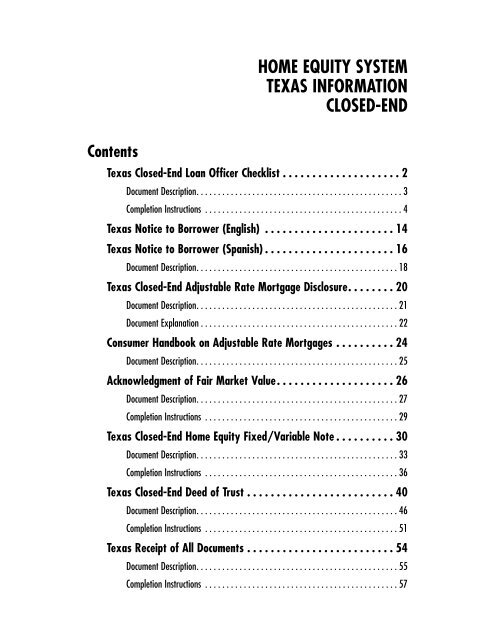

Home Equity System Texas Information Closed End Cuna Mutual

Todays mortgage rates in Texas 625 Rate 6409 APR as of 10042022 Choose a different state The mortgage rates shown assume a few basic things including.

. With a home equity loan you receive the entire loan. All loans are subject to credit approval and Credit Union of Texas lending policies. While inflation remains consistently high home equity loan and line of credit HELOC rates didnt see much movement last week increasing.

Home Equity Loan Rates Texas Oct 2022 best home equity. Texas law allows you to borrow up to 80 of your homes equity. Home Equity Loan Texas Oct 2022.

Home equity loans in Texas and Houston TX area provided by TheTexasMortgagePros - the best Texas mortgage broker offering the lowest rate and fee for your home loan needs. A sample loan payment for a fixed equity loan based on 75000 at. Most lenders will let you borrow up to 80 percent to 85 percent of your homes.

Meanwhile the rate on a 10-year HELOC is 654. If youre ready to put your homes equity to work for you print and complete the Home Equity Loan application and return it to your local FCB branch. Home Equity Loan Texas - If you are looking for a way to reduce your expenses then our trusted service is just right for you.

Frost Home Equity Loan rates shown are for the 2nd lien position. Contact Us for a Second Mortgage. Aside from a standard HELOC KeyBank also offers interest-only and rate-lock options.

18 rows NMLS ID. So in this case your loan maximum would be 40000. 639 Advertiser Disclosure APR Annual Percentage Rate is the rate that incorporates monthly.

1st lien products are available. The length of your loan will also affect your interest rates. When you apply for a HELOC you.

Low rates One-time approval SmartLock Fees at Closing With a Home Equity Line of Credit you can access up to 80 of the equity in your home at any time. A home equity loan is a lump sum that you borrow against the equity youve built in your home. Texas home equity definition.

Home equity loan amounts of 25000 and up are available while HELOCs have line. So for example if you have a home that is worth 200000 and you dont have a mortgage you have paid off 100 of your home the largest. Current Loan Rates Bank of Texas is your source for new and used auto loans home equity loans and lines of credit and personal loans.

For Wall Street Journal WSJ Prime call 866-376-7889. Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to-value ratio for. Texas law sets this at 80.

Ask a Frost Banker for details. Sometimes no news is good news. Whether youre buying a new vehicle.

Meanwhile the rate on a 10-year HELOC is 570. Other restrictions may apply. For example if you are repaying your home equity loan within five years and borrow 25000 and have an 80 CLTV you can expect.

7 Best Home Equity Loans Rates Lendedu

How Does A Home Equity Loan Work In Texas

Best Home Equity Loan Lenders Of October 2022 Forbes Advisor

9 Best Home Equity Loans Of 2022 Money

Slowdown In Home Equity Lending Raises Questions For 2020 Credit Union Journal American Banker

Market Trends Archives Page 5 Of 9 Accurate Group

Get Your Heloc From The Best Lender In Texas Learn About Helocs

Home Equity Loan On Investment Property

Best Heloc And Home Equity Loan Lenders In Texas Nextadvisor With Time

Current Heloc Rates Home Equity Line Of Credit Rate Com

Home Equity Loans And Helocs Average Closing Costs Valuepenguin

How Does A Home Equity Loan Work In Texas

Home Equity Loan America S Credit Union Texas

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

Home Equity Loan Vs Heloc What S The Difference

News Events Capitol Credit Union Texas Austin Round Rock Cedar Park

9 Best Home Equity Loans Of 2022 Money

Home Equity Loan Rates Discover Home Loans

Home Equity Line Of Credit Heloc Rates In October 2022 Bankrate